BIR files cases vs firms using ghost receipts; says confi funds needed vs tax evaders | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

BIR files cases vs firms using ghost receipts; says confi funds needed vs tax evaders

BIR files cases vs firms using ghost receipts; says confi funds needed vs tax evaders

Andrea Taguines,

ABS-CBN News

Published Nov 22, 2023 04:34 PM PHT

MANILA - Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. on Wednesday stressed the need for confidential funds so they can go after tax evaders.

MANILA - Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. on Wednesday stressed the need for confidential funds so they can go after tax evaders.

This was after the agency filed cases against companies involved in buying and selling fake or ghost receipts.

This was after the agency filed cases against companies involved in buying and selling fake or ghost receipts.

The BIR has requested P10 million in confidential funds for 2024. Lumagui said it will be used for further surveillance and investigation on tax evaders and illicit traders.

The BIR has requested P10 million in confidential funds for 2024. Lumagui said it will be used for further surveillance and investigation on tax evaders and illicit traders.

“Itong fake transactions or ghost receipts, makikita niyo ang tagal-tagal na nito. Decades na ang tinakbo ng kalakarang ito at ngayon lang nahuli. Marami ang kinakailangang surveillance dito, imbestigasyon,” he said Lumagui.

“Itong fake transactions or ghost receipts, makikita niyo ang tagal-tagal na nito. Decades na ang tinakbo ng kalakarang ito at ngayon lang nahuli. Marami ang kinakailangang surveillance dito, imbestigasyon,” he said Lumagui.

ADVERTISEMENT

“Hindi lang naman sa ghost receipts ginagamit yan. Nag-iimbestiga rin tayo sa mabigat na mga sindikatong involved sa illicit trade— andyan ang sa mga sigarilyo, illicit na vape products, kung saan-saan yan. Sindikato talaga ang involved dito at kung hindi natin bubuwagin ang mga sindikatong involved, ay talagang patuloy ang pagbagsak ng koleksyon dito sa excise tax,” he added.

“Hindi lang naman sa ghost receipts ginagamit yan. Nag-iimbestiga rin tayo sa mabigat na mga sindikatong involved sa illicit trade— andyan ang sa mga sigarilyo, illicit na vape products, kung saan-saan yan. Sindikato talaga ang involved dito at kung hindi natin bubuwagin ang mga sindikatong involved, ay talagang patuloy ang pagbagsak ng koleksyon dito sa excise tax,” he added.

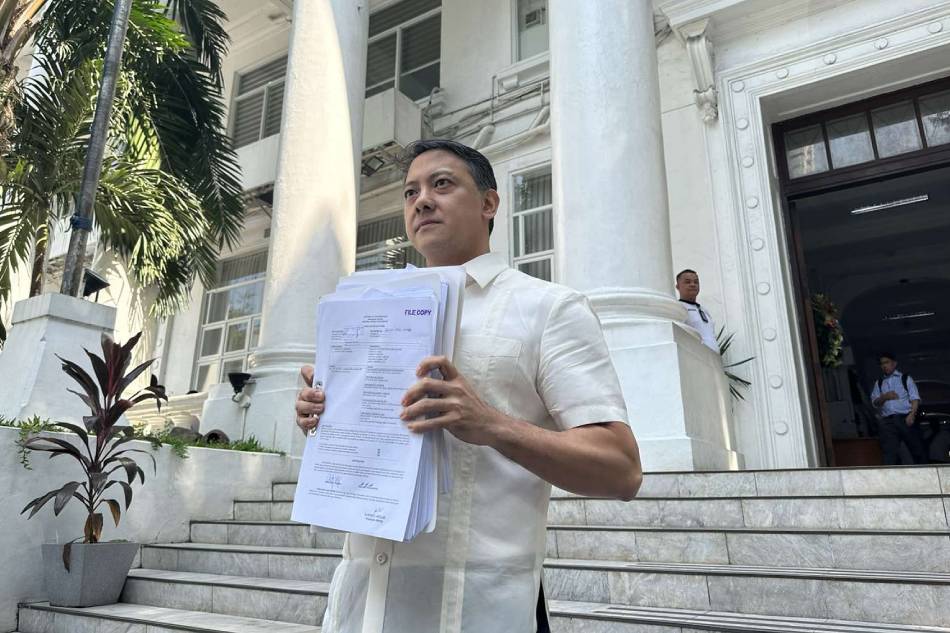

Lumagui personally went to the Department of Justice on Wednesday to file criminal cases against 69 corporations, corporate offices, and accountants involved in the buying and selling of fake or ghost receipts.

Lumagui personally went to the Department of Justice on Wednesday to file criminal cases against 69 corporations, corporate offices, and accountants involved in the buying and selling of fake or ghost receipts.

An estimated P1.8 billion in total tax liabilities were linked to the identified alleged erring taxpayers.

An estimated P1.8 billion in total tax liabilities were linked to the identified alleged erring taxpayers.

“Rehistrado ang mga korporasyon na ito sa SEC, rehistrado din sa amin sa BIR. They’re going through the process ng registration at kumukuha ng resibo. Pero again, walang produktong binebenta ito, walang serbisyong binebenta. Ang talagang binebenta lang nila ay mga resibong ito,” explained Lumagui.

“Rehistrado ang mga korporasyon na ito sa SEC, rehistrado din sa amin sa BIR. They’re going through the process ng registration at kumukuha ng resibo. Pero again, walang produktong binebenta ito, walang serbisyong binebenta. Ang talagang binebenta lang nila ay mga resibong ito,” explained Lumagui.

Lumagui noted that such ghost receipt sellers cater to several big companies from various industries such as construction and hardware, marketing of goods, office supplies, automotive oils, trading of metals, contractors of electrical and mechanical systems, hotel, and food services

Lumagui noted that such ghost receipt sellers cater to several big companies from various industries such as construction and hardware, marketing of goods, office supplies, automotive oils, trading of metals, contractors of electrical and mechanical systems, hotel, and food services

ADVERTISEMENT

“Meron nga isa nasa construction, sikat na sikat na construction firm ito. Mabigat-bigat ginawa nito dahil nakita rin nating hindi lang sila gumagamit ng ghost receipts pero tinututukan natin dahil nagre-refund pa ito. Although patuloy pa rin iniimbestigahan ang kanilang refund at kanilang mga resibo, pero ngayon, nasa mga P600 million ang (tax liability). Sa iisang corporation pa lang ito,” he said.

“Meron nga isa nasa construction, sikat na sikat na construction firm ito. Mabigat-bigat ginawa nito dahil nakita rin nating hindi lang sila gumagamit ng ghost receipts pero tinututukan natin dahil nagre-refund pa ito. Although patuloy pa rin iniimbestigahan ang kanilang refund at kanilang mga resibo, pero ngayon, nasa mga P600 million ang (tax liability). Sa iisang corporation pa lang ito,” he said.

Lumagui also issued a warning to lawyers and accountants who help facilitate the falsification of submissions to the BIR.

Lumagui also issued a warning to lawyers and accountants who help facilitate the falsification of submissions to the BIR.

“Sa mga accountants at mga lawyers, again, ang panawagan ko magbigay kayo ng tamang advice. Dahil kung ang inaabiso niyo dyan ay madaling takasan itong kaso na ito at kayang-kayang ayusin ito at hindi namin gagawin ang trabaho namin ay nagkakamali kayo,” he asserted.

“Sa mga accountants at mga lawyers, again, ang panawagan ko magbigay kayo ng tamang advice. Dahil kung ang inaabiso niyo dyan ay madaling takasan itong kaso na ito at kayang-kayang ayusin ito at hindi namin gagawin ang trabaho namin ay nagkakamali kayo,” he asserted.

ADVERTISEMENT

ADVERTISEMENT