China's answer to Kindle raises $1.1-B for Hong Kong listing | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

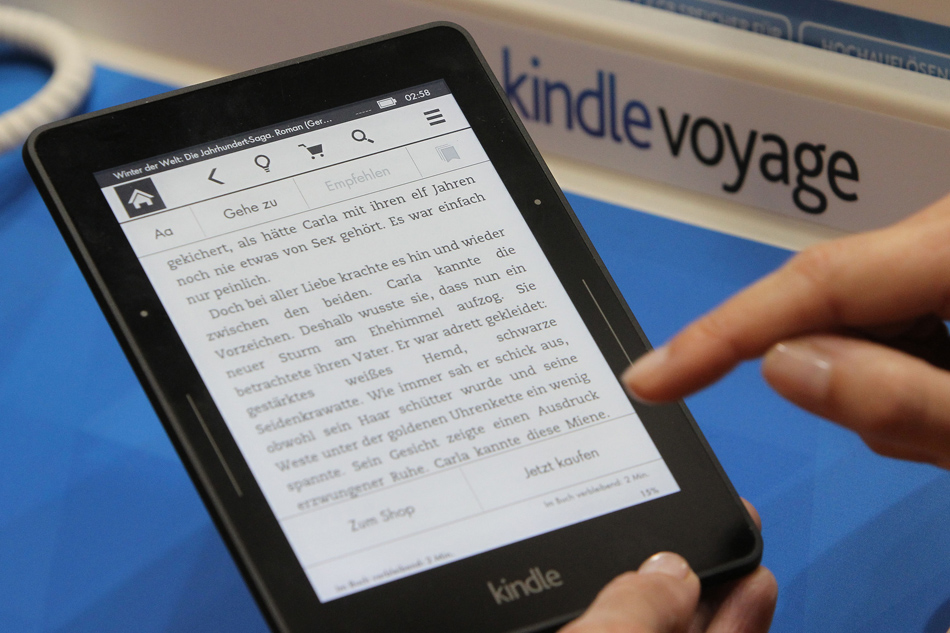

China's answer to Kindle raises $1.1-B for Hong Kong listing

China's answer to Kindle raises $1.1-B for Hong Kong listing

Agence France Presse

Published Nov 01, 2017 05:11 PM PHT

HONG KONG - Chinese internet giant Tencent's e-book arm has raised US$1.1 billion for a Hong Kong listing next week, reports said Wednesday.

HONG KONG - Chinese internet giant Tencent's e-book arm has raised US$1.1 billion for a Hong Kong listing next week, reports said Wednesday.

China Literature, the country's biggest online publishing business and Tencent's answer to Amazon's Kindle Store, saw 151 million shares priced at the top end of the offered range of HK$55 ($7.05) each, Bloomberg News said, according to people close to the deal.

China Literature, the country's biggest online publishing business and Tencent's answer to Amazon's Kindle Store, saw 151 million shares priced at the top end of the offered range of HK$55 ($7.05) each, Bloomberg News said, according to people close to the deal.

The internet giant owns 62 percent of China Literature, which called itself a "pioneer" of China's online literature market on its prospectus and said that it carries 6.4 million writers and 9.6 million literary works.

The internet giant owns 62 percent of China Literature, which called itself a "pioneer" of China's online literature market on its prospectus and said that it carries 6.4 million writers and 9.6 million literary works.

Formerly known as China Reading, the Shanghai-based company was created through a merger between Tencent's online literature arm and another Chinese internet publisher, Shanda Cloudary.

Formerly known as China Reading, the Shanghai-based company was created through a merger between Tencent's online literature arm and another Chinese internet publisher, Shanda Cloudary.

ADVERTISEMENT

The e-book firm is expected to list on Hong Kong's bourse on November 8.

The e-book firm is expected to list on Hong Kong's bourse on November 8.

China Literature's offering is the fifth-largest IPO in the city this year, according to Bloomberg News, with tech companies increasingly looking to list on the southern Chinese city.

China Literature's offering is the fifth-largest IPO in the city this year, according to Bloomberg News, with tech companies increasingly looking to list on the southern Chinese city.

Popular selfie app developer Meitu debuted on the Hong Kong stock exchange in December -- the largest IPO by a technology company in the city in almost a decade.

Popular selfie app developer Meitu debuted on the Hong Kong stock exchange in December -- the largest IPO by a technology company in the city in almost a decade.

The listing raised $629 million for the firm, which targets teenagers and young adults, primarily female, who use the beautifying app to retouch selfie photos.

The listing raised $629 million for the firm, which targets teenagers and young adults, primarily female, who use the beautifying app to retouch selfie photos.

Video game accessories maker Razer is also looking to list in Hong Kong and is expected to raise at least $400 million.

Video game accessories maker Razer is also looking to list in Hong Kong and is expected to raise at least $400 million.

Razer's chief executive officer Tan Min-Liang has already raised funds from Singapore's Temasek Holdings and from Hong Kong's richest man Li Ka-shing.

Razer's chief executive officer Tan Min-Liang has already raised funds from Singapore's Temasek Holdings and from Hong Kong's richest man Li Ka-shing.

ADVERTISEMENT

ADVERTISEMENT