Marcos says gov’t to 'deal sternly' with tax evaders | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Marcos says gov’t to 'deal sternly' with tax evaders

Marcos says gov’t to 'deal sternly' with tax evaders

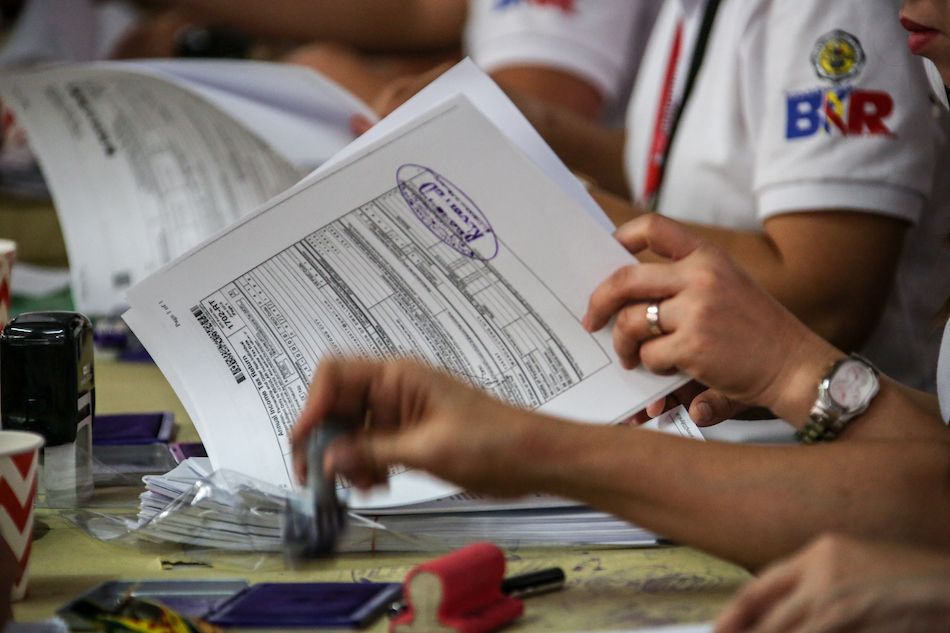

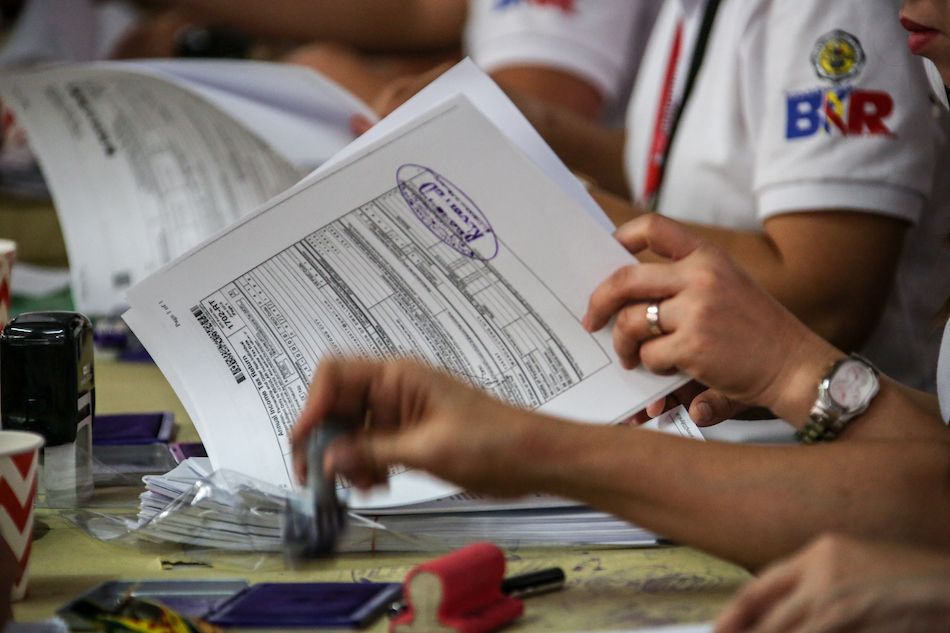

Revenue officers stamp tax documents at the Bureau of Internal Revenue Office (Regional District Office 7) in Quezon city, April 17, 2017. The Tax Bureau has said there will be no-extensions as representatives from various businesses attend to their taxes on its last day of filing. Jonathan Cellona, ABS-CBN News/File

Revenue officers stamp tax documents at the Bureau of Internal Revenue Office (Regional District Office 7) in Quezon city, April 17, 2017. The Tax Bureau has said there will be no-extensions as representatives from various businesses attend to their taxes on its last day of filing. Jonathan Cellona, ABS-CBN News/File

Revenue officers stamp tax documents at the Bureau of Internal Revenue Office (Regional District Office 7) in Quezon city, April 17, 2017. The Tax Bureau has said there will be no-extensions as representatives from various businesses attend to their taxes on its last day of filing. Jonathan Cellona, ABS-CBN News/File

Revenue officers stamp tax documents at the Bureau of Internal Revenue Office (Regional District Office 7) in Quezon city, April 17, 2017. The Tax Bureau has said there will be no-extensions as representatives from various businesses attend to their taxes on its last day of filing. Jonathan Cellona, ABS-CBN News/FileMANILA — President Ferdinand Marcos, Jr. on Tuesday urged Filipinos to pay proper taxes, underscoring that the government would “deal sternly with those who exploit the system unfairly.”

MANILA — President Ferdinand Marcos, Jr. on Tuesday urged Filipinos to pay proper taxes, underscoring that the government would “deal sternly with those who exploit the system unfairly.”

Filipinos should “pay what is due and recognize that in every peso that we paid lies the future that we make,” Marcos said during the launching of the Bureau of Internal Revenue’s (BIR) 2025 National Tax Campaign.

Filipinos should “pay what is due and recognize that in every peso that we paid lies the future that we make,” Marcos said during the launching of the Bureau of Internal Revenue’s (BIR) 2025 National Tax Campaign.

“We are here to be reminded that every honest contribution fuels something far more significant than just ourselves,” he said, noting that for the first time in 20 years, the BIR has met its target collection for a year.

“We are here to be reminded that every honest contribution fuels something far more significant than just ourselves,” he said, noting that for the first time in 20 years, the BIR has met its target collection for a year.

“I say this with hope and with sternness—hope that we all see the value in contributing to our country and that the law will deal sternly against those who exploit the system unfairly,” he said.

“I say this with hope and with sternness—hope that we all see the value in contributing to our country and that the law will deal sternly against those who exploit the system unfairly,” he said.

ADVERTISEMENT

“To the BIR, your mandate is clear—be watchful, be guardians of a system that ensures that every peso that is collected is channeled into programs that serve our people.

“To the BIR, your mandate is clear—be watchful, be guardians of a system that ensures that every peso that is collected is channeled into programs that serve our people.

To improve government revenue, the BIR has “implemented several efforts to strengthen its collections,” the President said, noting that among these initiatives are the “widening of the tax base through simplified key processes and documentary requirements, as well as the digitalization of the tax system.”

To improve government revenue, the BIR has “implemented several efforts to strengthen its collections,” the President said, noting that among these initiatives are the “widening of the tax base through simplified key processes and documentary requirements, as well as the digitalization of the tax system.”

“More than 307,000 establishments were visited and verified by the BIR, resulting in P257 million recovered through such compliance checks,” he added.

“More than 307,000 establishments were visited and verified by the BIR, resulting in P257 million recovered through such compliance checks,” he added.

“I have said this before: We will hold those who continue to circumvent our system accountable.”

“I have said this before: We will hold those who continue to circumvent our system accountable.”

Marcos also ordered the BIR to continue its crackdown on illicit goods, underscoring that its “Run After Fake Transactions” program has resulted in the “collection of more than P4.3 billion,” while “crackdowns on illicit trade in cigarettes, vapes, and other excisable goods led to the collection of more than P110 million last year.”

Marcos also ordered the BIR to continue its crackdown on illicit goods, underscoring that its “Run After Fake Transactions” program has resulted in the “collection of more than P4.3 billion,” while “crackdowns on illicit trade in cigarettes, vapes, and other excisable goods led to the collection of more than P110 million last year.”

RELATED VIDEO

Read More:

Ferdinand Marcos Jr.

Bureau of Internal Revenue

BIR

tax

tax evasion

crime

tax collection

politics

ANC

ANC promo

ADVERTISEMENT

ADVERTISEMENT