Growing your money: Should you put your savings in digital banks? | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Growing your money: Should you put your savings in digital banks?

Growing your money: Should you put your savings in digital banks?

Benise Balaoing,

ABS-CBN News

Published Jan 05, 2024 03:32 PM PHT

|

Updated Jan 05, 2024 04:53 PM PHT

MANILA – If you’re one of the lucky ones who still have some money left after the holidays, you may be thinking of how to grow what’s left of your 13th month pay and Christmas bonus.

MANILA – If you’re one of the lucky ones who still have some money left after the holidays, you may be thinking of how to grow what’s left of your 13th month pay and Christmas bonus.

If you want minimal risk, you can save it in a bank. But there are now several other options that promise to give better returns.

If you want minimal risk, you can save it in a bank. But there are now several other options that promise to give better returns.

DIGITAL BANKS

Digital banks have no physical branches and their financial products are processed entirely on digital platforms and online. They offer interest rates on savings that are several times higher than traditional banks.

Digital banks have no physical branches and their financial products are processed entirely on digital platforms and online. They offer interest rates on savings that are several times higher than traditional banks.

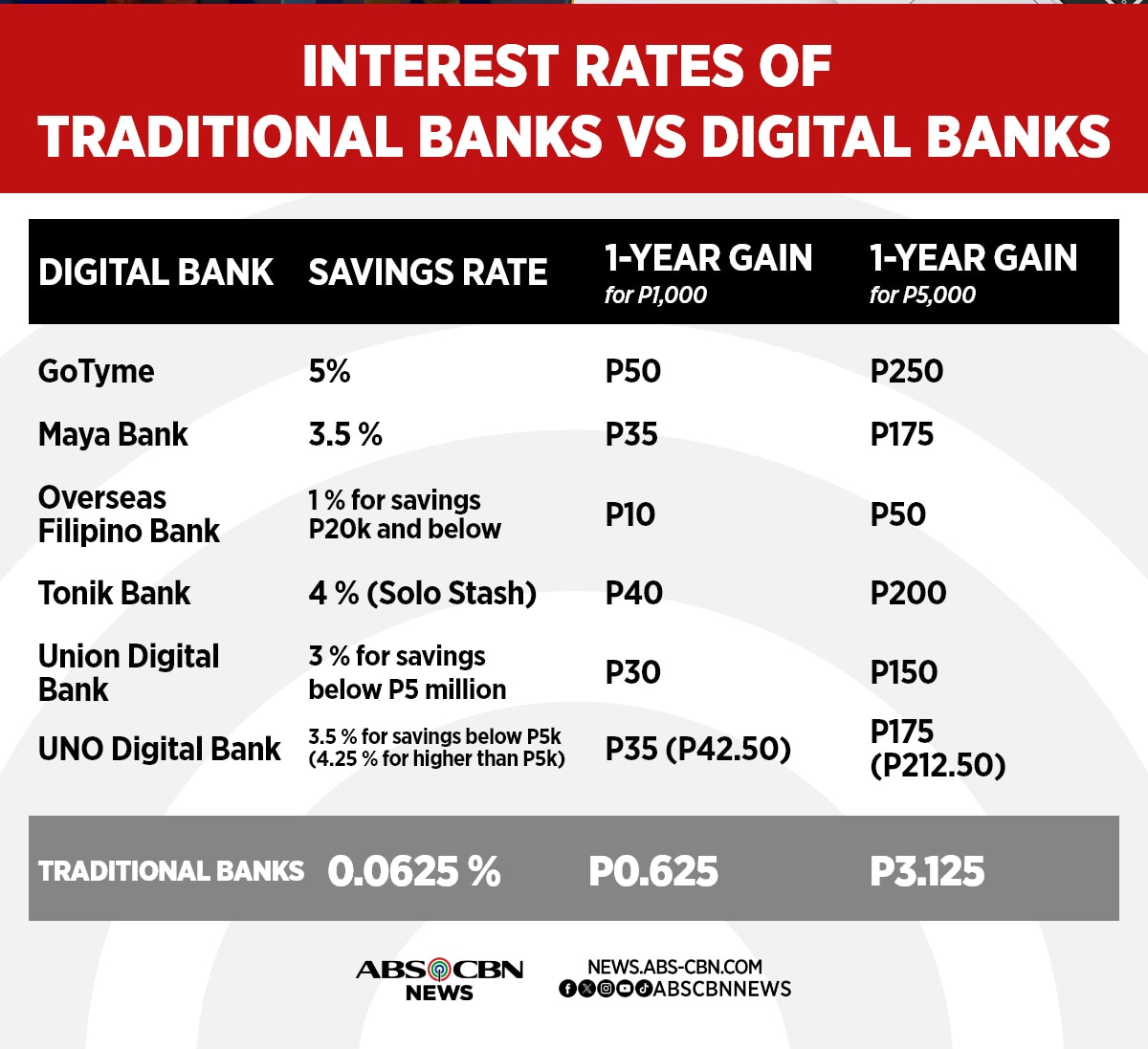

While traditional banks currently give 0.0625 percent interest per annum, some digital banks offer interest rates of 4 percent and even 5 percent.

While traditional banks currently give 0.0625 percent interest per annum, some digital banks offer interest rates of 4 percent and even 5 percent.

ADVERTISEMENT

Ian (not his real name) said he has made more than P2,500 in interest and cashback since he started using his digital bank account during the pandemic.

Ian (not his real name) said he has made more than P2,500 in interest and cashback since he started using his digital bank account during the pandemic.

“During the lockdowns doon ko talaga na-experience yung advantage ng digital wallets and digital banking,” the 47-year-old IT consultant told ABS-CBN News.

“During the lockdowns doon ko talaga na-experience yung advantage ng digital wallets and digital banking,” the 47-year-old IT consultant told ABS-CBN News.

Ian keeps his money in Maya Bank, which currently gives its users a 3.5 percent per annum interest rate on their savings. But users can also boost this rate by using their Maya e-wallet to pay for purchases. Special deposit products called “goals” get even higher interest rates.

Ian keeps his money in Maya Bank, which currently gives its users a 3.5 percent per annum interest rate on their savings. But users can also boost this rate by using their Maya e-wallet to pay for purchases. Special deposit products called “goals” get even higher interest rates.

GoTyme meanwhile gives a 5 percent per annum interest rate on savings. According to GoTyme CEO Nate Clarke, they can do this because they have much smaller overhead costs.

GoTyme meanwhile gives a 5 percent per annum interest rate on savings. According to GoTyme CEO Nate Clarke, they can do this because they have much smaller overhead costs.

While a traditional bank needs to rent space, construct a vault, hire tellers, security guards and other employees, digital banks don’t need to do any of these, Clarke said.

While a traditional bank needs to rent space, construct a vault, hire tellers, security guards and other employees, digital banks don’t need to do any of these, Clarke said.

ADVERTISEMENT

He estimates that for a digital bank, the cost of acquiring a customer is less than P250. In contrast, traditional banks spend around P2,500 for customer acquisition, Clarke said.

He estimates that for a digital bank, the cost of acquiring a customer is less than P250. In contrast, traditional banks spend around P2,500 for customer acquisition, Clarke said.

Union Digital Bank, which gives a 3 percent interest rate on savings below P5 million, said digital banks can provide higher interest rates because they are “lean.”

Union Digital Bank, which gives a 3 percent interest rate on savings below P5 million, said digital banks can provide higher interest rates because they are “lean.”

“We're asset-light, and we do not really have the operating overhead costs of the legacy banks,” said Union Digital Bank chief product officer Patricia de Villa.

“We're asset-light, and we do not really have the operating overhead costs of the legacy banks,” said Union Digital Bank chief product officer Patricia de Villa.

Tonik Bank, which gives 4 to 4.5 percent interest rates for special savings deposits called “stashes” said that not having any physical branch makes their operations more cost-efficient.

Tonik Bank, which gives 4 to 4.5 percent interest rates for special savings deposits called “stashes” said that not having any physical branch makes their operations more cost-efficient.

“Basically, we translate that savings into, well, customer savings and give our customers better interest rates,” said Tonik chief product officer Ed Joson.

“Basically, we translate that savings into, well, customer savings and give our customers better interest rates,” said Tonik chief product officer Ed Joson.

ADVERTISEMENT

UNO Digital Bank CEO Manish Bhai also said more people should bet on digital banking because of the convenience it offers.

UNO Digital Bank CEO Manish Bhai also said more people should bet on digital banking because of the convenience it offers.

Like traditional banks, accounts in digital banks are also insured up to P500,000 by the Philippine Deposit Insurance Corporation.

Like traditional banks, accounts in digital banks are also insured up to P500,000 by the Philippine Deposit Insurance Corporation.

FINANCIAL EXPERTS WEIGH IN

FINANCIAL EXPERTS WEIGH IN

Registered financial planner Aries Baloran said Filipinos should take advantage of the high savings interest rates offered by digital banks.

Registered financial planner Aries Baloran said Filipinos should take advantage of the high savings interest rates offered by digital banks.

Filipinos should save now before interest rates start tapering off, Baloran said.

Filipinos should save now before interest rates start tapering off, Baloran said.

However, eManagement for Business and Marketing Services Director for Financial Services and Strategy Jonas Ravelas said the convenience of digital banks may also work against depositors who want to control their spending.

However, eManagement for Business and Marketing Services Director for Financial Services and Strategy Jonas Ravelas said the convenience of digital banks may also work against depositors who want to control their spending.

ADVERTISEMENT

He said that while digital banks are convenient, a user may also end up using their savings because it is so easy to access.

He said that while digital banks are convenient, a user may also end up using their savings because it is so easy to access.

Efren Cruz, chairman of Personal Finance Advisers Philippines Corporation, agrees with this view.

Efren Cruz, chairman of Personal Finance Advisers Philippines Corporation, agrees with this view.

“It makes it easier for you to withdraw, to borrow, to buy stuff,” Cruz said.

“It makes it easier for you to withdraw, to borrow, to buy stuff,” Cruz said.

People who want to grow their savings should make it harder for themselves to touch these funds, he added.

People who want to grow their savings should make it harder for themselves to touch these funds, he added.

For Ravelas, digital bank accounts are good for everyday expenses.

For Ravelas, digital bank accounts are good for everyday expenses.

ADVERTISEMENT

“But for more serious planning, you stay with the traditional banks,” he said.

“But for more serious planning, you stay with the traditional banks,” he said.

Ian meanwhile said he sees how digital banks can make spending money easy. However, this doesn’t outweigh the advantages of digital banks.

Ian meanwhile said he sees how digital banks can make spending money easy. However, this doesn’t outweigh the advantages of digital banks.

“Mas malaki ang balik,” he said. Aside from the higher interest rate, his digital bank/e-wallet also gives cashback for purchases.

“Mas malaki ang balik,” he said. Aside from the higher interest rate, his digital bank/e-wallet also gives cashback for purchases.

Ian’s college student daughter “Lia” agrees.

Ian’s college student daughter “Lia” agrees.

“I think I would’ve been spending the money either way so better na rin that it’s earning kahit a little bit lang,” she said.

“I think I would’ve been spending the money either way so better na rin that it’s earning kahit a little bit lang,” she said.

Read More:

digital bank

fintech

personal finance

money growth

growing your money

personal investment

bank savings

savings interest rate

bank account

ADVERTISEMENT

ADVERTISEMENT