Watch out for foreign transaction fees when paying with a credit card abroad | ABS-CBN

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Watch out for foreign transaction fees when paying with a credit card abroad

Watch out for foreign transaction fees when paying with a credit card abroad

On a recent trip abroad, I saw a promotional offer for a credit card that advertised “no foreign transaction fees”. For those who travel often or love to shop online with international stores, this would be a great offer, and one I confess I would willingly snap up.

On a recent trip abroad, I saw a promotional offer for a credit card that advertised “no foreign transaction fees”. For those who travel often or love to shop online with international stores, this would be a great offer, and one I confess I would willingly snap up.

So far I have not discovered any credit card issuer offering the same thing in the Philippines (and if there is, feel free to let me know!). Discussing this with my friends while we were abroad made me realize not many know their credit card is charging them this fee, and just how much they were paying. Let me break this down here and hopefully help travelers become smarter with their credit card swipes this holiday season and beyond.

So far I have not discovered any credit card issuer offering the same thing in the Philippines (and if there is, feel free to let me know!). Discussing this with my friends while we were abroad made me realize not many know their credit card is charging them this fee, and just how much they were paying. Let me break this down here and hopefully help travelers become smarter with their credit card swipes this holiday season and beyond.

Foreign transaction fees apply to purchases made outside the country. But for some credit cards, you can also be charged foreign transaction fees for online purchases with international merchants. The rule here seems to be that if a foreign bank is involved in the transaction, there will be a foreign transaction fee.

Foreign transaction fees apply to purchases made outside the country. But for some credit cards, you can also be charged foreign transaction fees for online purchases with international merchants. The rule here seems to be that if a foreign bank is involved in the transaction, there will be a foreign transaction fee.

When you shop abroad, the transaction in the foreign currency will first be converted to pesos. After that, your credit card will add the foreign transaction fee. For example, if you buy a souvenir for $100, Mastercard or Visa would convert it to pesos, and then your credit card would charge an additional % of that amount as the foreign transaction fee.

When you shop abroad, the transaction in the foreign currency will first be converted to pesos. After that, your credit card will add the foreign transaction fee. For example, if you buy a souvenir for $100, Mastercard or Visa would convert it to pesos, and then your credit card would charge an additional % of that amount as the foreign transaction fee.

ADVERTISEMENT

According to the BDO credit card website, a “1 percent Cross Border Fee (except 0.8 percent for retail transactions and 0.5 percent for Cash Advance for UnionPay) and 1.5 percent Foreign Exchange Conversion Fee shall be applied on the converted amount based on the prevailing rate of Mastercard/Visa/JCB/UnionPay/Diners Club International and BDO respectively at the time of posting. The Foreign Exchange Conversion Fee is subject to change at the sole discretion of BDO.”

According to the BDO credit card website, a “1 percent Cross Border Fee (except 0.8 percent for retail transactions and 0.5 percent for Cash Advance for UnionPay) and 1.5 percent Foreign Exchange Conversion Fee shall be applied on the converted amount based on the prevailing rate of Mastercard/Visa/JCB/UnionPay/Diners Club International and BDO respectively at the time of posting. The Foreign Exchange Conversion Fee is subject to change at the sole discretion of BDO.”

BPI Credit Cards recently posted on its website that it will change its policy in February 2024 to this: “0.85 percent plus the Mastercard / Visa assessment fee of 1 percent shall apply to the converted amount of foreign-denominated transactions, using the foreign exchange rate of Mastercard / Visa at the time the transaction is posted.”

BPI Credit Cards recently posted on its website that it will change its policy in February 2024 to this: “0.85 percent plus the Mastercard / Visa assessment fee of 1 percent shall apply to the converted amount of foreign-denominated transactions, using the foreign exchange rate of Mastercard / Visa at the time the transaction is posted.”

Citibank credit card fees appear to be much higher as their website states: “All charges made in foreign currencies (whether online, overseas or local transactions) will be automatically converted to Philippine Peso on the posting dates at the prevailing exchange rate determined by Mastercard/Visa. For transactions in foreign currencies other than US Dollar, the amount will first be converted to US Dollar before being converted to its Philippine Peso equivalent. A fee of up to 3.525 percent will be imposed on the converted amount which represents our service fee and assessment fees charged by Mastercard/Visa.”

Citibank credit card fees appear to be much higher as their website states: “All charges made in foreign currencies (whether online, overseas or local transactions) will be automatically converted to Philippine Peso on the posting dates at the prevailing exchange rate determined by Mastercard/Visa. For transactions in foreign currencies other than US Dollar, the amount will first be converted to US Dollar before being converted to its Philippine Peso equivalent. A fee of up to 3.525 percent will be imposed on the converted amount which represents our service fee and assessment fees charged by Mastercard/Visa.”

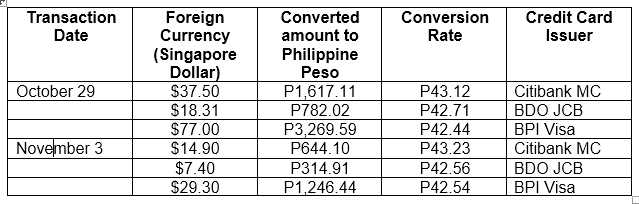

On a recent trip, I decided to use all 3 cards to test these fees in action. In my experience, BPI always had the lowest conversion rate, while Citi was consistently the highest. Sharing some of the actual charges here for comparison:

On a recent trip, I decided to use all 3 cards to test these fees in action. In my experience, BPI always had the lowest conversion rate, while Citi was consistently the highest. Sharing some of the actual charges here for comparison:

The expenses listed are small amounts, so you may feel that the conversion rate differences are not so bad. But what if you planned to buy big ticket items? All these things add up, and the more you know, the wiser your money decisions will be, including which credit card to swipe.

The expenses listed are small amounts, so you may feel that the conversion rate differences are not so bad. But what if you planned to buy big ticket items? All these things add up, and the more you know, the wiser your money decisions will be, including which credit card to swipe.

ADVERTISEMENT

If you own other credit card brands, don't worry. Credit card issuers are required to disclose all their fees to customers. You should receive the information at the time you receive your credit card, and any time since if there have been changes. Their websites should also post the fees and any updates so make sure to go and check before your next take off.

If you own other credit card brands, don't worry. Credit card issuers are required to disclose all their fees to customers. You should receive the information at the time you receive your credit card, and any time since if there have been changes. Their websites should also post the fees and any updates so make sure to go and check before your next take off.

-------------------

-------------------

Aneth Ng-Lim returns to writing after more than two decades of working as a communications specialist in the government and the private sector. Her advocacy for financial inclusion and personal finance began when she served as head of Consumer Education during her stint at a multinational bank.

Aneth Ng-Lim returns to writing after more than two decades of working as a communications specialist in the government and the private sector. Her advocacy for financial inclusion and personal finance began when she served as head of Consumer Education during her stint at a multinational bank.

Read More:

credit card

foreign transaction fees

personal finance

financial literacy

Aneth Ng Lim

Paying It Forward

featured blog

blogroll

ADVERTISEMENT

ADVERTISEMENT